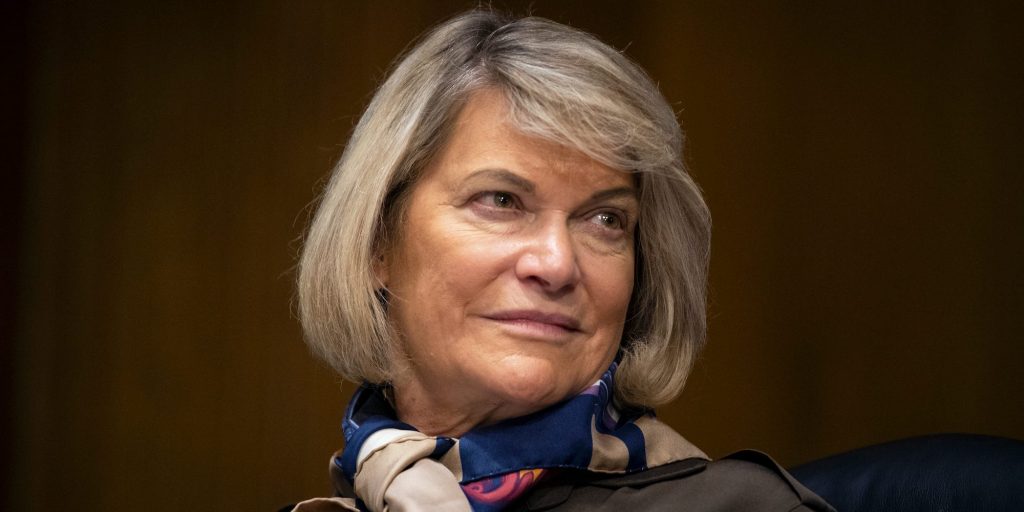

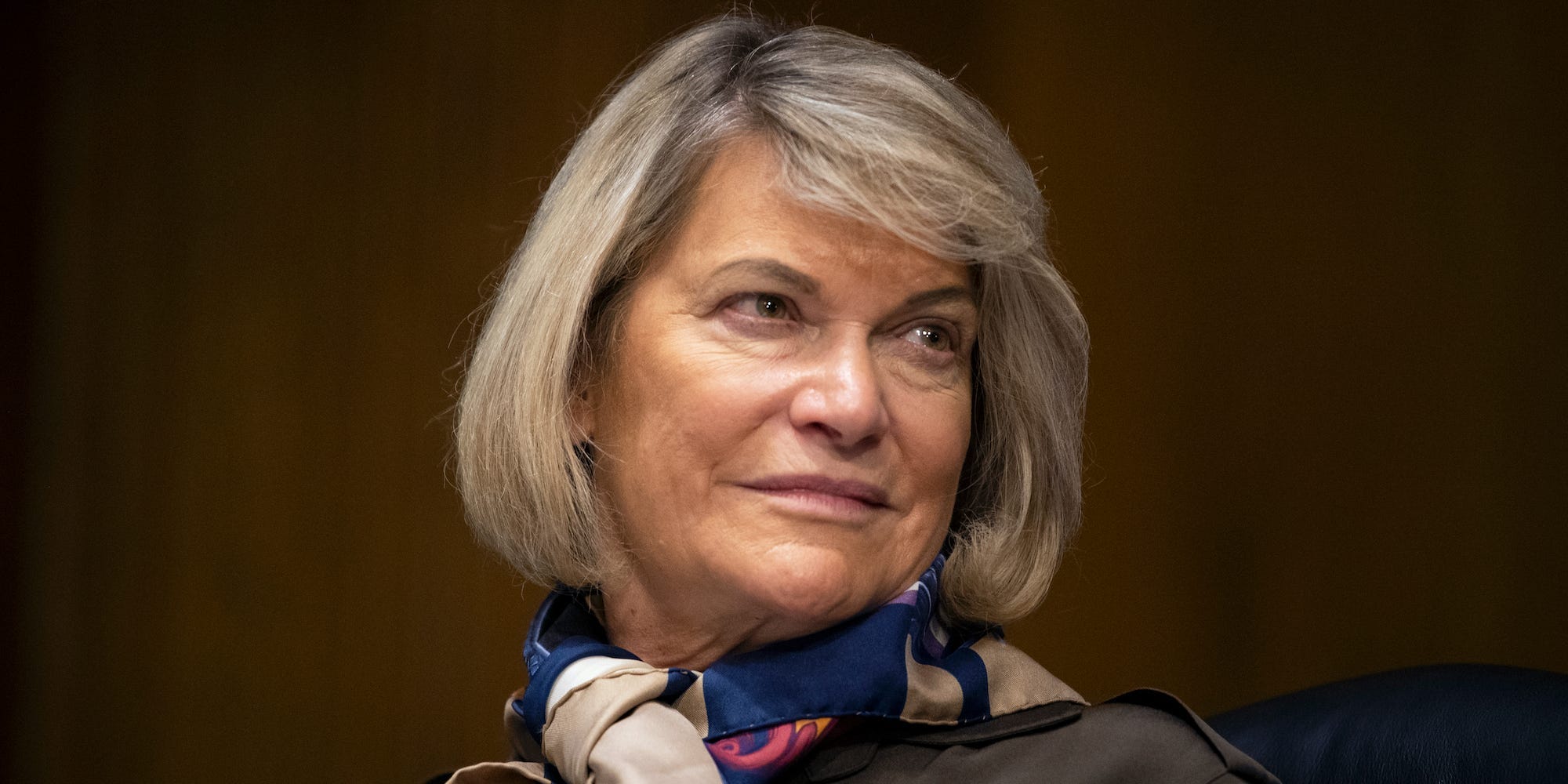

Caroline Brehman-Pool/Getty Images

- Wyoming Republican Sen. Cynthia Lummis said Wednesday that stablecoins should be fully backed by cash.

- She said that any regulatory framework for stablecoins will require full cash-backing, similar to a money market mutual fund.

- The bitcoin holder and outspoken crypto proponent added that stablecoins should follow anti-money laundering and sanctions laws.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Wyoming Republican Sen. Cynthia Lummis, a vocal crypto supporter, said Wednesday that stablecoins should be fully backed by cash.

Citing "novel risks" to the US economy, she said on the Senate floor that any regulatory framework for stablecoins will need to require full cash-backing, similar to a money market mutual fund.

"Stablecoins must be 100% backed by cash and cash equivalents, and this should be audited regularly," she said. "It may be the case that stablecoins should only be issued by depository institutions or through money market funds or similar vehicles."

Some stablecoins like tether and USD coin have generated controversy over whether their cash reserves are safe enough for a cryptocurrency supposedly equivalent to a dollar.

Lummis, a bitcoin holder who has been one of the most outspoken crypto proponents in the Senate, added that stablecoins should follow all relevant anti-money laundering and sanctions laws.

But as long as these regulatory issues can be sorted out, Lummis expressed bullishness on the role of stablecoins in the US economy.

"Properly supervised, stablecoins are not tantamount to the so-called wildcat banks of the 19th century," she said. "Stablecoins have an important role to play moving forward."

Last month, Lummis delighted crypto watchers when she helped propose a critical amendment to an infrastructure bill that fixed what critics called an overly broad definition of crypto "brokers." Though the amendment was ultimately scuppered, she won plaudits from crypto insiders.

"Without [Lummis's] amendment, the US will spend hundreds of millions collecting information on transactions that could never generate actual tax revenue," Marco Santori, Kraken's chief legal officer, told Insider previously.